Last updated on July 17, 2025

Let’s be honest, when you studied HR, you were probably excited about working with people, managing a workforce, and building stellar teams. However, you likely didn’t anticipate that a significant portion of your time would be spent on complex math equations and coordinating everyone’s time off.

Calculating PTO accrual rates can feel quite daunting, after all, you’re an HR whiz, not a mathematician! With all the formulas and calculations involved, it’s easy to get overwhelmed trying to understand complex topics like how vacation time is accrued and what method best suits your team. But don’t worry, we’re here to make it simple!

In this guide, we’ll break down the process of calculating vacation accrual rates, highlight some common errors to watch out for, and show you how automating can save you time, money, and your sanity!

What is PTO Accrual?

PTO accrual refers to the process by which employees gradually earn PTO over time. Rather than receiving a lump sum of PTO each year, time off is calculated as a ratio of hours or days worked, often called the ‘PTO accrual rate.’

Employers can choose to calculate vacation accruals however they like, with it sometimes differing based on tenure, employment status, or seniority. They also set the accrual period, meaning how often the employees' PTO balances are updated.

How to Calculate PTO Accrual Rates: A Step-by-Step Guide

Step 1: Determine Annual PTO

The first step in calculating PTO accruals is to establish the total number of PTO hours or days your company offers each employee per year. Be sure to consider the leave laws and regulations in your country of operation to ensure compliance. For example, European countries often mandate generous leave policies, with Austria having 25 vacation days, while the US has no federally mandated minimum, relying on companies to decide appropriate PTO policies.

Step 2: Choose the Start Date

The start date for PTO accruals is a critical factor in determining how and when your employees begin accumulating their paid time off. This date sets the foundation for how PTO balances are calculated, reset, and managed throughout the year.

Employers commonly choose between these three options:

Calendar Year: The calendar year starts on January 1st and ends on December 31st. This means that all employees’ balances reset on the first day of the year unless you allow rollovers.

Fiscal Year: Some organizations prefer to sync everything up to their fiscal year to simplify finances and taxes. An organization’s fiscal year can start at any point in the year.

Hire Date: Hire date accruals depend on the employees' start date or the end of their probation period. This is more complex to calculate as everyone’s accruals periods start and reset at different moments.

Step 3: Choose the Accrual Rate

Next, you’ll need to decide the accrual rate, meaning how often employee balances get updated.

Here are some of the most common options:

Annual Accrual Rate

With an annual accrual rate, employees receive a fixed amount of PTO at the beginning of the year. This method works well if you have a team of full-time, salaried employees who have been with the company for several years, but the downfall is employees need to wait a whole year before being awarded time off.

Here’s an example:

James is hired in August 2024. His contract provides him with 20 days of PTO at an annual accrual rate.

His PTO balance will remain at 0 until August 2025, when he will receive his full 20 days.

James can use those 20 days throughout the year, with them resetting in August 2026.

Hourly Accrual Rate

The hourly accrual rate refers to PTO earned based on the number of hours worked. This method makes the most sense if your workforce is composed of part-time employees working hourly schedules that vary. Their PTO balances directly reflect the hours they’ve put in, ensuring fairness for your entire team.

Here’s an example:

Julie worked 14 hours this week, and Andy worked 2.

Since PTO is accrued proportionally based on hours worked, Julie will accrue 7 times more PTO than Andy for this week.

Bi-Weekly PTO Accrual Rate

The bi-weekly accrual rate method is popular because it aligns with payroll schedules, especially for companies that pay their employees every two weeks. This method allows employees to accrue PTO consistently with each paycheck, simplifying PTO tracking for both employees and HR.

Here’s an example:

Andy earns 80 hours of PTO each year.

He earns these hours in even fractions every 2 weeks.

Step 3: Calculate PTO Accrual Rate

The last step is to actually do the math! Let’s run through the different formulas together.

Calculate Annual Accrual Rate

No need to be a math pro for this one—this vacation accrual rate is the simplest because it doesn’t require calculations. Employees get their PTO days added all at once each year.

Calculate Hourly Accrual Rate

Calculating hourly accrual rate is a little bit more complex. However, it provides employees with very accurate PTO balances based on how much they’ve worked.

Here is the formula for calculating your hourly accrual rate:

[Maximum Hours of Annual PTO] ÷ [Hours Worked Per Year]

Let’s use Blossom & Vine flower shop as an example:

Blossom & Vine offers full-time employees a maximum of 160 hours of annual PTO.

Full-time employees work 2080 hours each year (40 hours per week x 52 weeks per year).

Their hourly accrual rate is: 160 [ maximum hours of annual PTO] ÷ 2080 [hours worked per year] = 0.077.

This means that employees accrue 0.077 hours of PTO per hour worked.

So, if a part-time employee works 15 hours per week, they will accrue 1.16 hours of PTO each week (15 x 0.077). Similarly, a full-time employee working 40 hours a week will accrue 3.08 hours of PTO each week (40 x 0.077).

See how this distributes PTO evenly and fairly for employees based on how much they work?

Calculate Bi-Weekly PTO Accrual Rate

To calculate bi-weekly PTO accruals, we need to modify the previous formula. Before, we were dividing up the PTO based on hours worked, now, we’re calculating based on weeks in a year.

Since the accruals will happen bi-weekly, we know that means 26 times per year, so here is the formula:

[Maximum Hours of Annual PTO] ÷ [26 Accrual Periods]

This time, let’s use Sole Mates shoe shop as an example:

Sole Mates offers full-time employees a maximum of 80 hours of annual PTO.

Their hourly accrual rate is: 80 [ maximum hours of annual PTO] ÷ 26 accrual periods = 3.08 hours of PTO every 2 weeks.

This works well for full-time salaried employees who will accrue PTO consistently. Since most companies have bi-weekly payroll, teams will know that each paycheck means they receive an additional 3.08 hours of PTO.

This accrual rate can be adjusted for part-time employees by adjusting the maximum amount of annual PTO based on your leave policy.

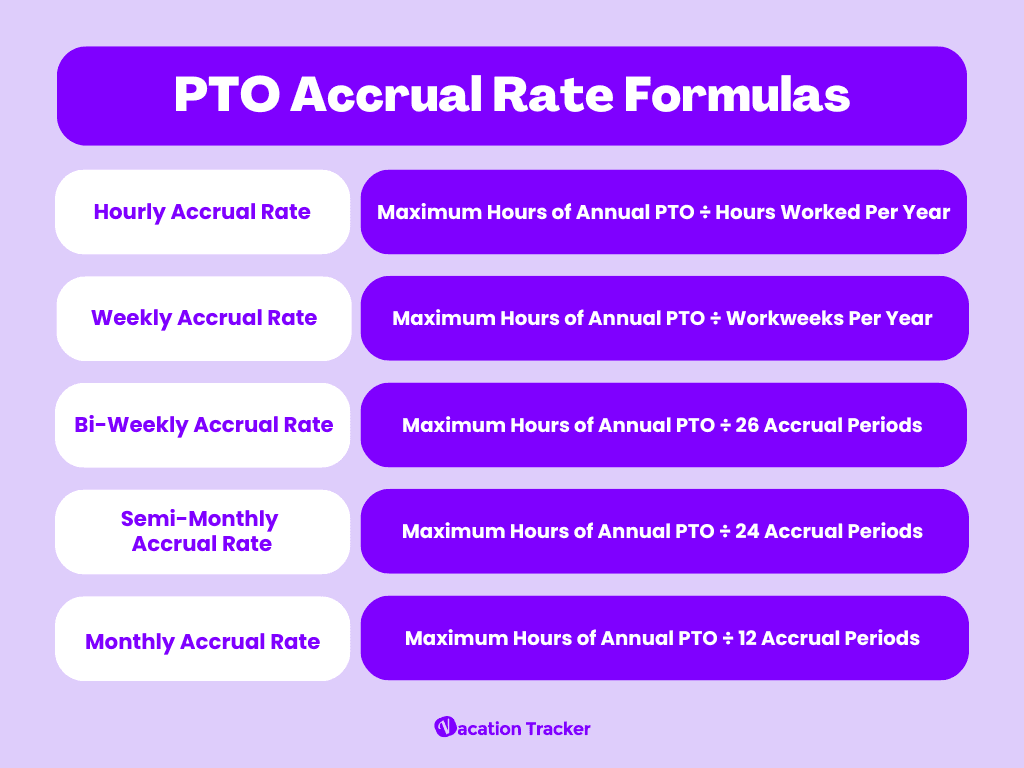

Now that you understand the basics, you can modify these formulas to fit your business needs. Some organizations choose to have semi-monthly, monthly, or weekly accrual periods. Here’s a handy chart to help you keep track of all your options and how to calculate them:

Remember to customize the numbers you enter to match the policies of your organization. Our examples are based on a standard five-day, 40-hour workweek, if your organization differs from this, you’ll need to modify the formulas accordingly!

💡 Having a hard time explaining to your team how much accrued vacation they have? Share our handy PTO accrual calculators with them to make it easy for them to understand and keep track of their earned time off.

Additional Considerations

Now that we’ve tackled the basics of calculating PTO accrual rates let’s explore some other factors that can significantly impact how your vacation accruals work.

Each of these factors plays a crucial role in shaping your PTO policy and ensuring that your accrual system is both fair to employees and manageable for your organization.

Accrual Caps

Accrual caps are the maximum limit on how much PTO an employee can accumulate. Once this cap is reached, employees stop accruing additional PTO until they use some of their existing balance. This means your leave management system needs to be set up to pause or limit accruals.

Rollovers

If your company allows PTO to roll over from one year to the next, it can affect how much time off employees can accrue in the following year. For example, your organization may decide to adjust PTO accrual rates or set up accrual caps to make sure that PTO doesn’t accumulate indefinitely.

Probation Periods

New hires who start mid-year often have a probation period during which they don’t accrue PTO. This can affect the accrual calculations, as these employees may accrue PTO at a different rate or for a shorter period in their first year, ensuring fairness and consistency across your team.

Tiered PTO accrual

Many companies offer higher accrual rates depending on employee tenure or roles. For example, seasoned employees may accrue more PTO, while high-stress roles might have faster vacation accruals as part of wellness initiatives. This approach rewards loyalty and meets the varying needs of different roles.

Holiday Accruals

Some policies don't allow employees to accrue PTO during time off, requiring you to modify your formulas to reflect fewer work hours, days, weeks, or months per year. It's essential to check your country’s laws before making this decision, as PTO and holiday policies vary widely by country. Your accrual system should be tailored to comply with local regulations while meeting the needs of your organization and employees.

Common Mistakes in PTO Accrual Calculations

Even with the best intentions, errors in PTO accrual calculations can happen, leading to inconsistencies and confusion.

Here are some of the most common mistakes to watch out for:

- Calculation Errors: Double-check your work! You don’t want to be basing your company’s PTO on an incorrect equation or typo. If you’re using manual methods, like pen and paper or spreadsheets, always ensure your formulas are consistent, and your math is right for accurate PTO balances.

- Not Differentiating Between Leave Types: Vacation days are just one type of leave! Make sure you’re considering other types of PTO, like sick days or personal days, and setting up formulas to calculate those accruals as well.

- Ignoring Variations in PTO Policies Across Locations: For companies with employees in multiple locations, failing to account for different local or regional PTO regulations can lead to non-compliance and errors in accrual calculations. Always ensure that your policies are aligned with local laws.

The Cost of Calculating Accruals Manually

Employers might be reluctant to spend their budget on new software solutions, but are they considering the hidden costs of time-consuming and error-prone manual tasks?

Time is money! A 2023 study found that each manual data entry by an HR professional without self-service technology costs an average of $4.78, covering labor, form production, accuracy checks, and data transfer into the HR system. This means that every entry you automate saves you nearly $5.

And, of course, manual tasks are subject to more mistakes, which cost the company even more! According to a 2022 study by Ernst & Young, errors in vacation, PTO, or sick time requests cost companies an average of $219,289 per 1,000 employees. This includes common mistakes such as incorrect earnings for PTO, PTO requested that is not available or accrued, and PTO time not entered or approved in a timely manner. Say it with me: Ouch!

It's clear that manually calculating and managing PTO isn't just detrimental to productivity and employee satisfaction; it also hurts the bottom line.

How Automation Simplifies PTO Tracking

The good news is that these costs and headaches can be avoided. Automating your PTO tracking and accrual processes can save you both time and money while reducing errors.

A leave management software cannot only automate all accrual calculations but also all of your leave management. That’s right, no need to manually update PTO balances or spend all day figuring out where you went wrong in your Excel sheet formulas, it’s all done for you.

By using Vacation Tracker, you can now input your company’s accrual policy once by selecting the accrual type and accrual period, and our software takes care of the rest. Administrators enjoy powerful PTO accrual management features, like capping the amount of PTO accrued, pausing accruals for specific employees, and allowing your team to request leave based on future vacation accruals.

Each leave policy can have its own accrual rules, including different accrual rates and periods. Since your PTO management system already tracks employee leave, accruals, and balances are automatically calculated and adjusted to reflect the policies you input.

This not only reduces the risk of human error but also frees up your time to focus on more important tasks, like building and supporting your team. All you need to do is manage the settings; the rest happens automatically.

![]()

Beyond accruals, here are some Vacation Tracker features we think you’ll love:

Self-service portal: Employees get complete visibility into their PTO balances and can easily make requests and receive approvals in minutes, reducing the administrative burden on HR.

Shared calendar: Enjoy a bird’s-eye-view of your team's PTO to avoid workflow disruptions and keep things running smoothly.

Unlimited leave types: Configure as many leave types as needed to meet your team's needs, including WFH, sick leave, jury duty, and, of course, vacation!

Multiple locations: Ensure compliance by managing leave policies, including accruals, holidays, and PTO allowances by location.

Notifications: Keep everyone in the loop with daily or weekly notifications. Customize the information by filtering by departments, locations, or labels to see only the information you want.

Reliable reporting: Real-time data and exportable reports allow you to make data-driven insights and optimize your workforce management.

Seamless integrations: Effortlessly manage employee PTO without leaving Slack, Microsoft Teams, or Google Workspace.

By automating these processes, you ensure accuracy and efficiency in your PTO management. It’s a win-win for everyone involved, and it ultimately contributes to a smoother, more productive work environment.

Ready to start saving your organization money and optimizing the way you work? Test out all our features in a free 7-day trial.

Claudia

Claudia is an experienced marketer with a passion for writing and creating engaging content that connects with readers.