Last updated on July 10, 2025

Managing employee vacations isn’t just about scheduling time off, it’s also about managing a financial responsibility. Every unused vacation day or paid time off hour an employee earns becomes a cost your company will eventually have to pay.

Leave liabilities can quietly grow into a hefty sum if not monitored. In fact, companies in the U.S. collectively carry hundreds of billions of dollars in unused vacation owed to employees.

That’s why staying on top of leave liabilities is essential for HR professionals, finance teams, and business owners alike. In this article, we’ll break down what leave liabilities are, how to calculate them, the challenges they pose, and best practices to manage them proactively. Let’s dive in!

What are leave liabilities?

In simple terms, leave liabilities represent the value of unused paid time off that a company owes to its employees. Whenever an employee earns vacation days, personal days, or other paid leave but doesn’t take them, those hours accrue as a balance the company must either allow the employee to rollover or eventually pay out.

For example, if an employee leaves the company or retires with unused vacation days, most leave laws require the employer to compensate them for that time. That owed amount is a liability on the company’s books until the leave is used or paid.

Not all leave types are treated this way. Some leave like sick days or bereavement leave might not accrue or carry a payout obligation. However annual vacation or general PTO is typically a major source of leave liability.

Why do leave liabilities matter for businesses?

Financial Impact

Unused paid leave is like a hidden expense: it doesn’t show up in daily operations, but it will be due eventually. If you ignore these liabilities, you could face a nasty surprise when multiple employees decide to cash out unused days or when someone with a large balance resigns.

Plus, carrying heavy leave liabilities can affect your financial statements. Accounting standards generally require that accrued paid time off be recorded as a debt on the balance sheet. Lenders or investors looking at your books will consider these obligations.

Employee Well-Being

If leave liabilities are high, it often means employees aren’t taking enough time off. This can lead to burnout and lower productivity. Encouraging employees to use their vacation time is not only good for them, but it also helps keep liabilities in check, making it a win-win for workplace wellness and your balance sheet.

Companies that proactively manage leave and make sure people take vacations regularly, tend to have happier teams and lower financial risk due to excessive accrued leave.

How Companies Calculate Leave Liabilities

Understanding that leave liabilities are essentially the cost of unused PTO, how do companies actually calculate this number? The good news is the math itself is usually straightforward; the challenge is in tracking the data.

Accrued leave is typically calculated per employee, and then summed up company-wide.

The simplest formula for each employee’s leave liability is:

Accrued Leave Balance (in hours or days) × Pay Rate (per hour or day) = Leave Liability Value

Let’s break down how to do this.

For each employee, determine how much paid leave they have accumulated but not used. This is their accrued leave balance.

Then, figure out the financial value of that leave. This usually means multiplying the unused hours by the employee’s hourly pay rate or converting days to a dollar amount based on salary.

For example, if an employee has 40 hours of unused PTO and earns $25 per hour, their leave liability is 40 x $25 = $1,000. If another salaried employee has 5 unused vacation days and their daily pay comes to $200, that’s $1,000 as well.

You would repeat this for every team member and then add it all up. The total is the leave liability your company owes.

![]()

However, the accuracy of these numbers depends on correctly tracking how leave is accrued in the first place. Different companies have different PTO policies, some give a lump sum of days each year, while others accrue time off incrementally each pay period.

If you need a refresher on how PTO accrual works, check out our guide on pto accruals for everything you need to know about earning leave, and how to calculate your employees' pto accrual rate!

These leave policies affect how you calculate liability. For instance, if your policy allows unused days to rollover indefinitely, the liability can keep growing year after year. If you cap rollover, meaning employees can only carry a maximum number of days into the next year, then your potential liability per employee is limited by that cap (plus whatever they accrue in the current year).

Accurate records of each employee’s accrued hours and up-to-date salary information are needed for precise liability calculations. This is why many businesses use dedicated PTO software to handle these computations automatically.

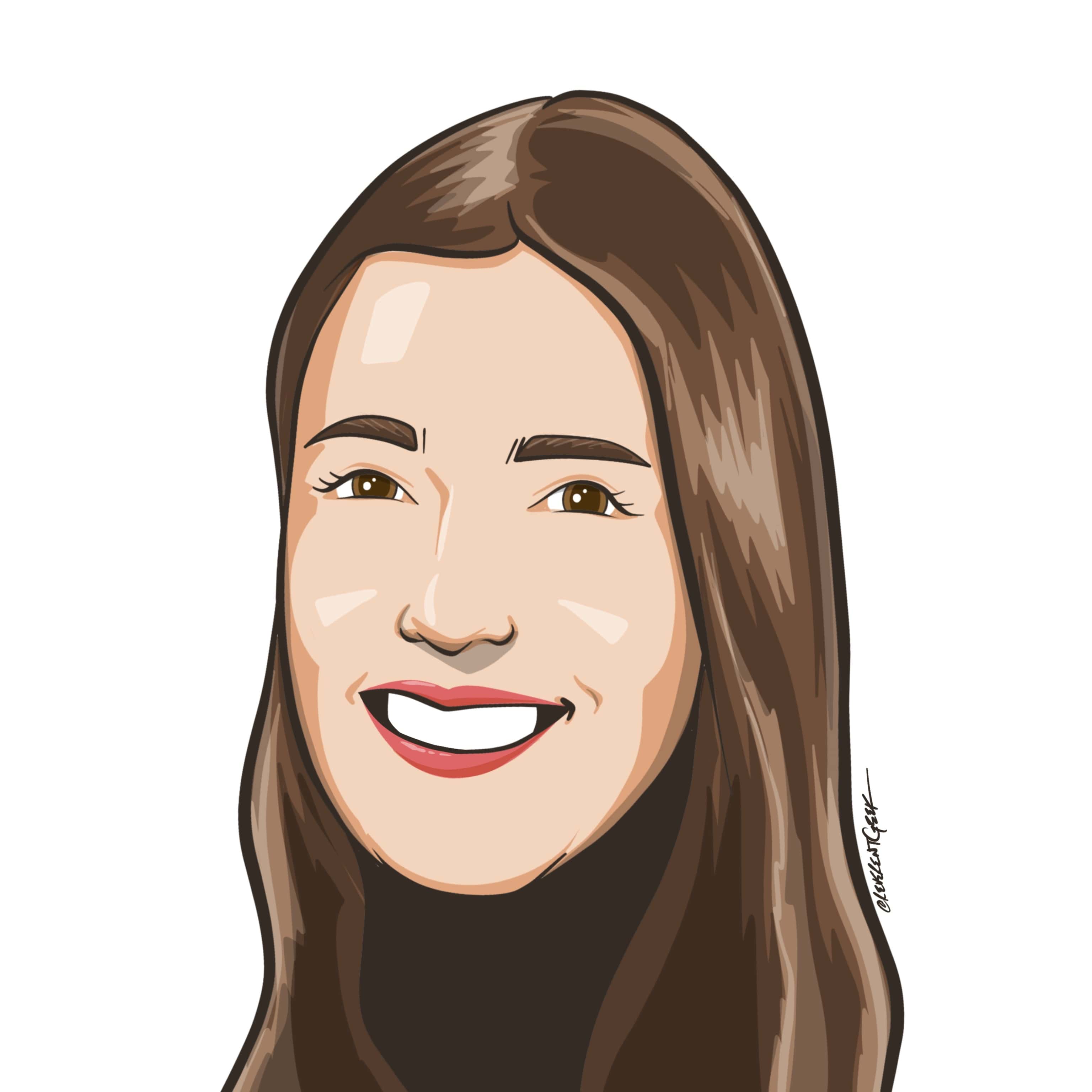

Challenges in Managing Leave Liabilities

Calculating a leave liability at a given moment is one thing; managing it over time is another challenge altogether. Small and medium businesses often struggle with this, not because the math is hard, but because of how leave liabilities can sneak up on you and what they imply for your operations and finances.

Financial risks and cash flow impact

One major challenge with growing leave liabilities is the potential hit to your budget or cash flow when those liabilities are due. If many employees have large accrued leave balances, there could be a time, like year-end or upon resignation, when a lot of leave gets taken or paid out in a lump sum.

Even if employees don’t leave, if several decide to take long vacations around the same period, you might need to spend on temporary coverage or overtime for others, indirectly impacting finances.

From an accounting perspective, leaving liabilities unmanaged might give a false sense of security. On paper, you might appear to have lower expenses in the short term since those vacation hours aren’t paid out yet, but that’s misleading. Eventually, the expense hits when the leave is taken or paid.

Compliance and reporting challenges

Leave liabilities are also intertwined with labor laws and company policy compliance. Depending on where your business operates, there may be regulations on how you must handle unused leave.

For example, many U.S. states require that accrued vacation cannot be forfeited – it must either roll over or be paid out (no “use it or lose it” for those states), effectively guaranteeing it as a liability. Other places, like several European countries, allow or even mandate a “use it or lose it” approach, meaning that unused vacation is forfeited if not used by year-end.

Keeping track of these rules is crucial. If you operate in multiple states or countries, you may have to manage leave accrual and liability differently for each location to stay compliant.

That’s a challenge for HR: mismanaging it could mean not just unhappy employees, but potential legal issues or fines.

Operational challenges

If leave liabilities are high because employees haven’t been taking time off, you might face a situation where suddenly many people want to use their banked time. That can lead to scheduling headaches, covering shifts or key roles when multiple team members are out.

It’s a classic “feast or famine” problem: no one takes vacation for a long stretch, then everyone wants to take it at once, impacting operations. Managing how leave is taken throughout the year is a crucial part of managing the liability.

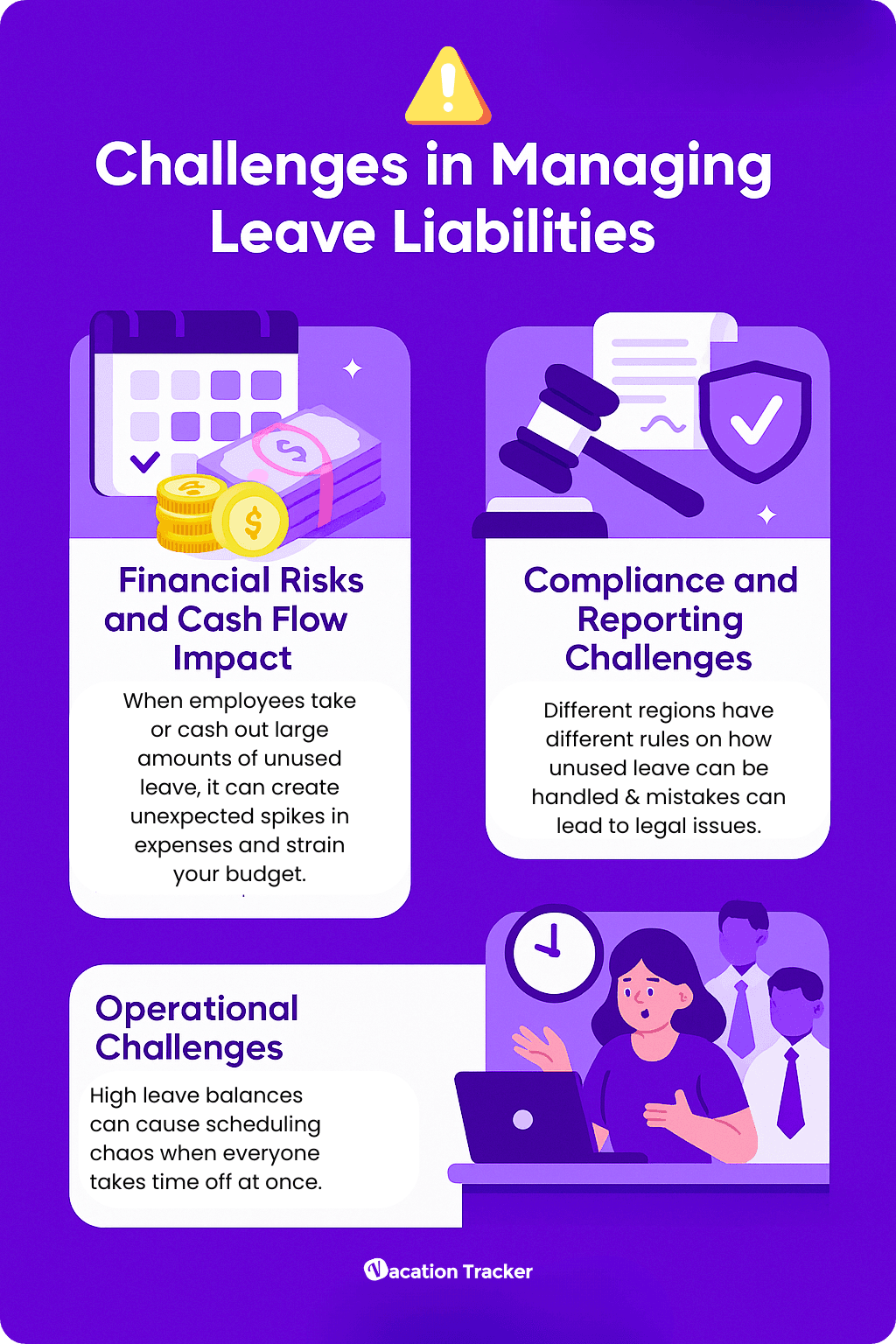

Best Practices for Managing Leave Liabilities

Given the challenges, what can small and medium-sized businesses do to keep leave liabilities under control? Here are some best practices that HR and finance teams can implement together to mitigate risks while keeping employees happy.

Encourage employees to take leave regularly

One of the simplest and most effective ways to manage leave liability is to prevent it from accumulating excessively in the first place. Create a workplace culture that supports taking time off.

HR can lead the charge by reminding employees throughout the year to use their vacation days, especially if they haven’t taken any in a while. Leadership should set an example too. When managers and owners take vacations and disconnect, it signals to everyone that it’s truly okay to take earned time off

The idea is to avoid a situation where someone hasn’t taken a day off in two years. Not only does encouraging regular vacations reduce the financial liability, but it also boosts employee morale and productivity in the long run.

Set rollover limits

One way to control leave liabilities is by limiting how much paid time off employees can rollover into the next year. Setting a PTO accrrual cap helps prevent excessive accruals and encourages employees to take time off regularly.

For example, you might allow employees to carry over up to 10 days, but anything above that is either forfeited or paid out. This puts a clear upper bound on liability.

Be mindful of local laws. Some regions don’t allow forfeiting leave. Where permitted, a cap can motivate employees to use their time rather than lose it and protect the company from long-term financial buildup.

Use automation and reporting tools

Trying to track everyone’s leave balances manually, in spreadsheets or paper forms, is a recipe for errors and oversights. Investing in an automated leave management system can save a ton of time and provide real-time accuracy.

Tools like Vacation Tracker automatically track how much PTO each employee has accrued and used. This kind of software can handle different accrual rules without you having to crunch numbers repeatedly. Plus, both employees and managers can see leave balances at a glance, request time off, approve requests, and have the system update balances instantly.

Automation is a classic win-win: it saves administrative time and helps catch issues early.

Implement financial planning strategies

To handle leave liabilities wisely, start by making it a habit to review your leave liability regularly. This can be as simple as running a report of all accrued leave hours and converting it to dollars. By keeping leadership informed of this figure, you can proactively decide if any action is needed.

Next, consider including accrued leave payouts in your budget or reserves. Some businesses set aside a certain amount of money each month or year into a reserve fund for future PTO payouts. This way, when an employee does leave and cash out a big balance, the money is already accounted for and reserved, it won’t hit your operational cash flow unexpectedly.

Some companies periodically offer PTO buyback programs, where they might offer to pay out up to X days for anyone who wants to convert some leave to cash. This can reduce liabilities, though it does cost money. Depending on your cash position and how critical it is to lower the liability.

Update your policies

As your business grows, you’ll need to re-evaluate your PTO policy.

What worked for 5 employees might not work for 50. Consider introducing tiers of accrual to prevent very long-term employees from accumulating, say, 10+ weeks of unused leave.

Additionally, ensure your handbook outlines what happens to unused leave each year and at employment termination. Clear rules reduce uncertainty and help both HR and finance plan accordingly.

How Vacation Tracker Helps

Leave liabilities might start out as a small line item, but if left unattended, they can grow into a major financial and operational concern. Because leave liabilities are based on how much unused paid time off employees have, they’re only as accurate as the data behind them. That’s why it’s important to make sure that data is accurate and visible across your organization.

Vacation Tracker is designed to automate and simplify every aspect of tracking employee time off, helping you maintain reliable records, apply policies consistently, and keep leave liabilities under control.

Error-Free PTO Data

Vacation Tracker takes the manual work out of tracking PTO. You can set up your company’s leave policies in the system, customizing how PTO is accrued, rollover rules, and accrual caps and it will automatically track each employee’s earned and used time off.

![]()

This means no more updating spreadsheets or worrying about calculation mistakes. Rules are applied consistently, and records are centralized, so if you ever need to verify balances or calculations, everything’s accurate and in one place.

Real-time visibility and reporting

Vacation Tracker provides dashboards and reports that give you an immediate view of leave balances across the organization. HR or finance can pull a report of all leave balances in a couple of clicks, no need to chase managers or comb through emails.

This makes it easy to calculate your total leave liability using current data. The tool shows how much time each employee has on hand. and who hasn’t taken leave in a while.

With this visibility, you can act before liabilities become a problem.

![]()

Encouraging smart leave usage

Vacation Tracker promotes healthier leave habits and makes requesting time off feel easy and accessible. When employees can easily see their PTO allowance, they’re more likely to use it.

Plus, with Slack and Microsoft Teams integrations, employees can request leave in seconds, directly from a workspace that feels familiar. That simplicity helps reduce unused PTO and the liabilities that come with it.

![]()

Ready to Automate?

By using Vacation Tracker, businesses can significantly reduce the administrative burden and the risk of errors or surprises related to PTO balances.

The result?

You save time, you stay informed, and you reduce the likelihood of facing an overwhelming PTO payout situation. It’s about making leave management effortless so you can focus on your business, not on counting hours.

Ready to say goodbye to surprises and hello to peace of mind? Try our software today, for free!

Claudia

Claudia is an experienced marketer with a passion for writing and creating engaging content that connects with readers.