Last updated on July 16, 2025

PTO is a critical benefit in today’s workplace, but PTO works differently for exempt and non-exempt employees. Exempt employees (typically salaried staff) and non-exempt employees (typically hourly workers) fall under different rules when it comes to overtime, pay, and how their time off is managed.

Whether you run a tech startup or manage a construction crew, understanding how PTO applies to exempt and non-exempt employees helps you meet legal requirements and build fair, transparent policies

What Does Exempt and Non-Exempt Mean?

Definition of Exempt Employees

In the United States, exempt employees are those who meet specific criteria under the Fair Labor Standards Act (FLSA) that “exempt” them from overtime pay requirements.

To qualify as exempt, an employee typically must:

- Earn a fixed salary of at least $684 per week (set to increase to around $1,128 in 2025);

- Perform duties classified as executive, administrative, or professional (e.g., managing staff, using independent judgment, or applying specialized knowledge);

- Receive consistent pay regardless of hours worked, with limited exceptions.

Definition of Non-Exempt Employees

Non-exempt employees are essentially everyone else who is covered by overtime and minimum wage laws. A non-exempt employee is typically paid hourly and must receive overtime pay (usually 1.5 times their regular rate) for any hours worked over 40 in a workweek.

Common examples include hourly workers like customer service representatives, construction crew members, retail employees, and administrative assistants. Some non-exempt employees are salaried, but if their pay is below the threshold or their duties don’t meet exemption criteria, they still qualify for overtime.

![]()

How PTO Works for Exempt Employees

Accrual of PTO for Exempt Employees

Exempt employees, being salaried, earn PTO differently than hourly workers. Many organizations give salaried staff a fixed number of PTO days per year.

Some companies opt for lump-sum PTO for exempt staff, giving the entire PTO entitlement at once, often at the beginning of the year. Others use per-pay-period accruals to prevent someone from using an entire year’s vacation if they haven’t yet worked a full year

PTO accrual for exempt employees is usually based on a full-time schedule, and not based on hours worked. For instance, an exempt manager working full-time would accrue the same number of PTO hours each pay cycle, regardless of whether they worked 38 hours or 50 hours that week.

PTO Usage for Exempt Employees

Using PTO when you’re an exempt employee tends to be flexible. Because exempt staff don’t need to clock in/out, they often have more freedom in how they take time off. Companies commonly require exempt employees to use PTO in half-day or full-day increments.

For example, if a salaried employee needs just two hours in the morning for an appointment, some employers might not dock any PTO; the employee simply makes up the time later or is trusted to handle their responsibilities.

However, they are still expected to use PTO for significant time away. An employer will usually require that if they're going to be out for a day or more, they request and log those days.

Legal Considerations for Exempt Employees

While there’s no law requiring employers to offer PTO to exempt employees (in the U.S.), the FLSA sets strict rules around how their pay is handled. Exempt employees must receive their full salary for any week in which they perform work, with very limited exceptions.

One key exception is when an exempt employee takes a full day off for personal reasons and has no PTO left, in that case, a full-day pay deduction is allowed. However, partial-day deductions from pay are not permitted. Employers may deduct from an exempt employee’s PTO balance for partial-day absences, but if no PTO is available, the employee must still be paid in full to maintain exempt status.

To remain compliant, employers should have clear PTO usage policies for exempt staff, often requiring PTO to be used for absences of a half-day or more. Some organizations allow employees to “borrow” against future PTO to account for time off while preserving salary requirements. Improper deductions can jeopardize an employee’s exempt classification, potentially exposing the company to retroactive overtime pay obligations.

In addition, some states consider accrued vacation time as earned wages, meaning unused PTO may need to be paid out when an employee leaves the company. Accurate recordkeeping ensures compliance with these requirements and supports proper final payouts.

Once PTO is offered, it may also be treated as part of the compensation agreement, especially if outlined in an offer letter or contract. Failing to honor it can result in legal claims.

How PTO Works for Non-Exempt Employees

Accrual of PTO for Non-Exempt Employees

For non-exempt employees, PTO is typically accrued in direct proportion to the hours they work. Instead of getting a chunk of days per year, an hourly worker often earns PTO for each hour on the job.

A common approach is to grant a certain fraction of an hour of PTO for every hour worked. For example, a company might give 1 hour of PTO for every 30 hours worked (about 0.033 hours of PTO per hour worked). At that rate, a full-time employee working 40 hours a week would accrue roughly 1.33 hours of PTO each week, which adds up to about 2 weeks per year.

PTO Usage for Non-Exempt Employees

Hourly employees generally have more structured PTO usage requirements. They can’t simply decide at noon to take the rest of the day off without notice; doing so would likely mean losing pay for those hours or even violating attendance policy if not approved.

Using PTO for a non-exempt worker typically involves requesting the specific hours or days off in advance and getting manager approval to ensure coverage.

One key aspect is incremental usage. Unlike exempt staff who might only log PTO in half or full-day blocks, non-exempt employees often can use PTO in small increments, even as little as 1 hour at a time. This flexibility is great for employees but requires precise tracking.

If an hourly employee doesn’t have enough PTO accrued and needs time off, the result is usually unpaid time. This contrasts with exempt employees who might still be paid even if they’ve exhausted PTO for a partial-day absence.

Legal Considerations for Non-Exempt Employees

Managing PTO for non-exempt employees requires careful attention to both federal and local labor laws. Under the FLSA, non-exempt employees must be paid time-and-a-half for any hours worked beyond 40 in a workweek. However, PTO hours do not count toward that 40-hour threshold. This means employees who work 40 hours and also take 8 hours of PTO would be paid for 48 hours, but would not be eligible for overtime.

Employers may choose whether to include overtime hours in PTO accrual calculations. Some cap accrual at 40 hours per week to avoid granting additional leave for already higher-paid hours, while others offer bonus PTO for overtime as a retention incentive, for example, one extra day off for every 50 overtime hours worked. These additional benefits are discretionary.

It’s essential that companies clearly state in their PTO policy that overtime is based on hours worked, not hours paid, to prevent confusion. Precise tracking is also critical. If overtime and PTO fall in the same pay period, records should distinguish between actual hours worked and paid time off to ensure accurate payroll and compliance.

In addition to federal overtime rules, many jurisdictions require paid sick leave accrual for non-exempt employees, including part-timers. California and New York City mandate that employees earn 1 hour of sick leave for every 30 hours worked. Some companies integrate this sick leave into a general PTO bank, while others keep it separate. Either way, employers must carefully track usage and balances to stay compliant.

Ensuring Compliance with International PTO Regulations

Managing PTO across borders adds complexity, but a few best practices help ensure compliance.

First, always localize your PTO policy. It’s fine to have a global time-off policy as a framework, but add country-specific addendums or rules to meet local leave laws.

💡Pro tip: Use our Leave Laws resource to make sure your policy is compliant with your country's regulations for all types of leave, from Vacation to sick days, parental leave, and more. Explore the resource

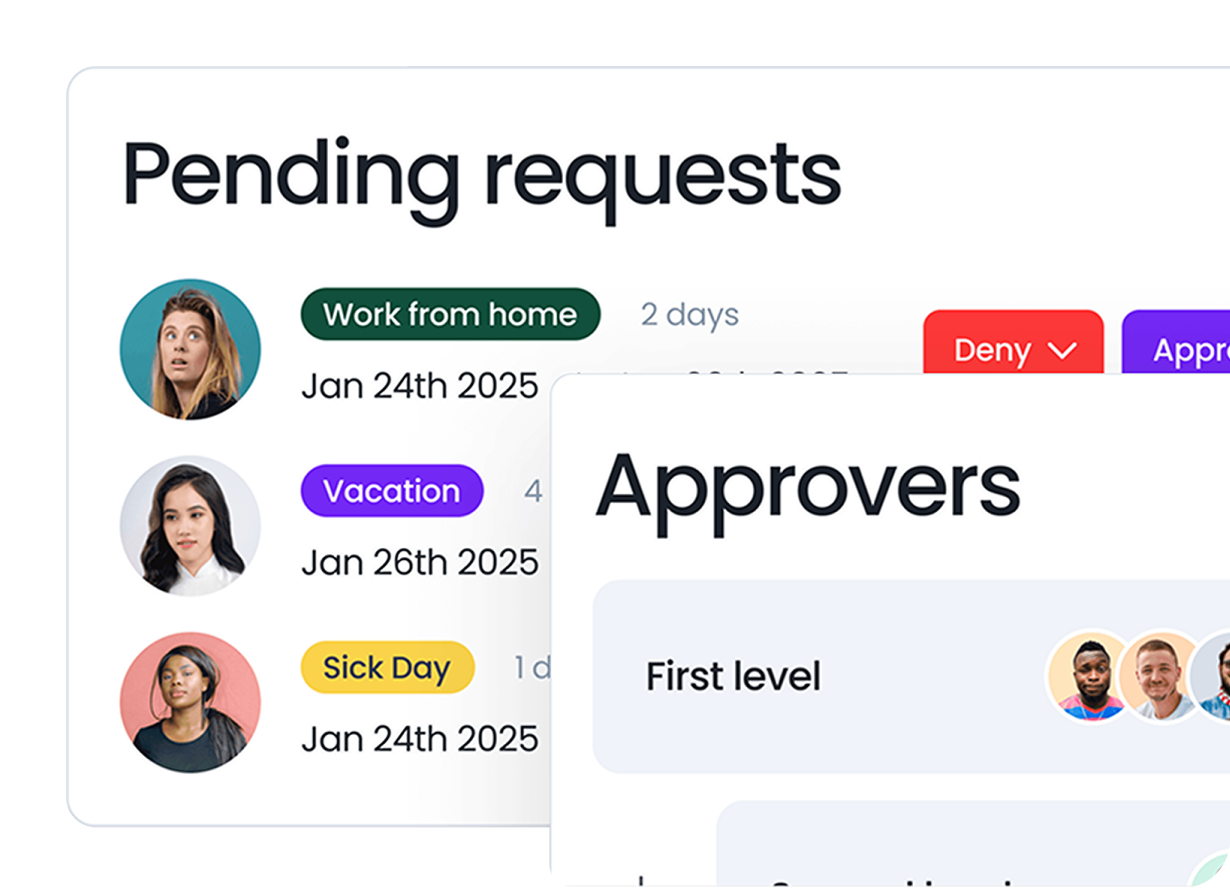

Second, use automated leave management systems to stay compliant. Keeping track of varying accrual rates, rollover allowances, and usage restrictions manually is error-prone.

A leave management system like Vacation Tracker can be configured to enforce different PTO rules for different locations automatically. For example, you can set the system to accrue 10 hours per month for employees in one country vs. 8 hours in another, or to automatically stop accrual at the legal maximum. It will also apply the correct local holidays. This ensures you don’t accidentally short an employee on their legal time off or let an unused balance slip through the cracks.

![]()

It’s also important to document your policy and communicate it. Compliance isn’t just about the law, it’s about transparency. Clearly outline for your team in writing how PTO works, especially if you have both exempt and non-exempt staff or multi-country teams.

Finally, regularly review and update your PTO policies. Laws change. For instance, the U.S. salary threshold for exempt status may increase, or new leave laws could pass like new parental leave or sickness policy laws.

Auditing your policy annually is a good practice. This way, you’ll catch compliance issues proactively. And when in doubt, be generous: providing a bit more PTO or flexibility than the legal minimum can protect you from violations and also boosts employee morale.

Best Practices for Managing PTO Across Employee Types

How to Create Fair PTO Policies for Exempt and Non-Exempt Employees

Creating a PTO policy that feels fair to both exempt and non-exempt employees is crucial for morale.

Here are some strategies:

- Align Benefits Where Possible: If your exempt employees get a very generous PTO package, consider how you can offer meaningful benefits to non-exempt employees too.

- Tenure and Role Appropriate Policies: It can be fair to differentiate PTO by role or seniority but do so thoughtfully. Many companies give senior employees or managers more PTO days. This is fine as long as everyone in similar roles/status has the same opportunity.

- Consider Workload and Flexibility: Recognize that exempt employees often have more flexibility in when they take off, whereas non-exempt schedules are more rigid. To balance this, you could build in a little extra PTO or some floating half-days for hourly staff. Alternatively, encourage managers to provide flexibility to hourly employees in other ways, like shift-swapping or occasional remote work.

- Avoid Unintentional Bias: Ensure that your PTO policy doesn’t inadvertently favor one group in a problematic way. The goal is for everyone to feel that the PTO policy is designed with their needs in mind.

Technology and Tools for Tracking PTO

The administrative side of managing PTO for both exempt and non-exempt employees can get complicated. This is where PTO tracking software comes in. Instead of using spreadsheets or paper forms, Vacation Tracker helps you:

- Automate Accruals: Set up accrual rules and the system handles the rest. No manual calculations, no errors, just accurate balances updated in real time. Plus, employees can see their up-to-date PTO balance anytime without asking HR, which improves transparency.

- Apply and Enforce Custom PTO Policies: Whether you’re managing carryover caps, waiting periods, or regional differences, the software applies your policies automatically, keeping everything consistent and compliant across employee types.

- Maintain Compliance Records: Track PTO earned, taken, and carried over in one place. If you’re ever audited or need to verify information, detailed records are just a few clicks away.

![]()

- Support Fair and Transparent Leave Management: Dashboards give managers and HR a clear view of who’s taking time off, who’s not, and whether anyone is at risk of burnout or policy misuse.

- Standardize Requests and Approvals: Built-in workflows reduce back-and-forth and help you avoid undocumented verbal requests. Every approval is logged and traceable.

![]()

With so many moving parts, different accrual methods, eligibility rules, and compliance requirements, PTO tracking can quickly become overwhelming without the right system in place. Vacation Tracker simplifies that complexity, giving you the confidence that every policy is applied correctly, every record is accurate, and every request is handled consistently. It’s not just about saving time, it’s about creating a reliable, fair, and compliant PTO process for your entire team.

Key Takeaways for Employers and Employees

Managing PTO for exempt and non-exempt employees doesn’t have to be complicated. The key is understanding how their roles differ.

With clear, fair policies that outline how time off is earned and used, you can avoid confusion and build trust across your team.

But remember, the right tools can make a big difference. A PTO tracking system like Vacation Tracker automates the heavy lifting, gives employees real-time visibility, and helps managers keep everything organized.

Ready to simplify PTO for every employee type? Book a demo and see how Vacation Tracker can make tracking, compliance, and approvals easier, no spreadsheets required.

Tracking Can Be

Learn how to manage time off without

confusion, delays, or admin headaches.

Claudia

Claudia is an experienced marketer with a passion for writing and creating engaging content that connects with readers.